$1000 OAS Payment 2025 in September: Hello Canadians, Are you guys excited for your next OAS payment??? Yes, it is arriving on the 25th of September. Even if, along with that, you are going to receive your CPP along with your GIS at the same time. If you are getting the OAS, or even if you are not receiving it, you are going to get other monthly benefits added to your financial boost stimulus. OAS, or the Old Age Security scheme, is there, prevailed, or offered in Canada to boost the senior citizens who are falling at age 65 or older than this. OAS is nothing but a public pension scheme that helps the retirees at their retirement.

These stimulus checks are there to help the low-income senior or married or even single persons, widows, or, we can say, the needy ones to manage their day-to-day expenses. The qualified or eligible senior citizens of Canada are evaluated on the basis of their age, income threshold, and residency to get the benefit, rather than valued on the basis of their cuts from the salary during the period of their working. If they get their qualification approved for such additional programs like the Guaranteed Income Supplement and the Allowance and the Allowance for Survivors.

The seniors falling in between their 60 to 64 can apply for this. They will be able to get more than $1,000 extra every month if they qualify for additional programs such as the Guaranteed Income Supplement and the Allowance.

OAS, or Old Age Security payment, as its name suggests, is the security for many older people. In the year they will turn 65, they will start receiving the OAS or make themselves eligible. From July to September, during this period the COLA gets adjusted as the review has been going on. To cope with the inflation,, the prices get adjusted, as do the benefits.

Eligibility Requirement to Get OAS Payment:

The seniors need to qualify for the basic criteria to get the OAS. So, at first, they have to be 65 or more than 65 years old if they want to get this benefit. They must be residents of Canada; that means they have to live here for at least 10 years after turning 18, and then if someone is living outside Canada and applying for the benefit, then they have to live there for at least 20 years after turning 18.

$1000 OAS Payment 2025 in September

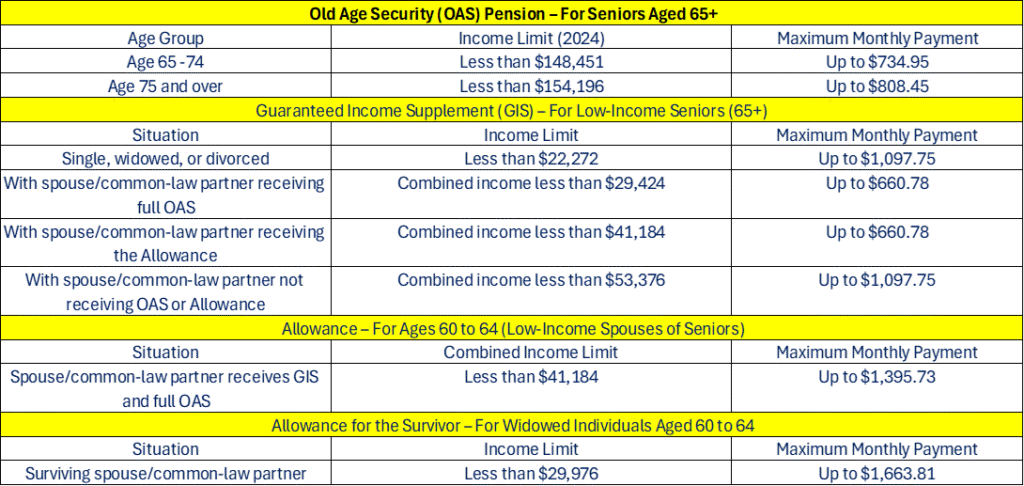

The maximum pay-out can any of the seniors get is $734.95 who are in between the age of 60 to 74. After turning 75, they can maximize their benefits and can get $808.45. The income threshold must have been less than $148,451 for the 65 to 74-year-old people, and it should be less than $154,196. The date for the amount disbursement is 25th September.

If there is something extra then it is noticeable and should be informed. The seniors can get GIS along with other Allowances benefits other than OAS. So, let’s dive in.

What is GIS or Guaranteed Income Supplement and Allowances/ Allowances for survivors?

GIS or Guaranteed Income Supplement is also a monthly benefit which is non taxable in nature and given to the seniors if they are at their 65 or older. As we know in OAS the maximum benefit can reach up to below $1000. But here the seniors can get over $1,000. The seniors have to make themselves eligible to get the benefit. This income supplement is based or calculated on the income threshold. The applicants have to live in the Canada. In the case of sponsored immigrants, if they have not lived in Canada for 10 years then they will not get GIS. The Income thresholds and the benefits as per the Income is given there below.

| Particulars | Maximum GIS Monthly Payment | Income Threshold |

| if the beneficiary is Single, widowed, or divorced senior | $1,097.75 | Less than $22,272 |

| if the beneficiaries are married and they are both are combining their income (one spouse receives full OAS) | $660.78 | Their combined income has to be under $29,424 |

| Couple (spouse is eligible for the Allowance) | $660.78 | Their combined income has to be under $41,184 |

| if they are married and they are not receiving OAS or the Allowance | $1,097.75 | Household income under $53,376 |

So as a combination of benefits, if the seniors are receiving both the OAS and GIS, then their monthly benefit will surpass more than $1000.

Let’s see who can get the Allowance. Allowance is also a monthly benefit given to the older seniors who are married and they are in the age bracket of 60 to 64, not eligible to get OAS and GIS. But the condition is only those can get the Allowance, whose partner or spouse is already getting GIS. They have to possess the legal residency of Canada. There is another benefit known as Allowance for survivors which is given to the person who have lost their spouse and not yet eligible for OAS and GIS.

Those who are eligible to receive the Allowance only their income threshold must be less than $41,184 combining both of their income and the spouse will get maximum up to $1,395.73. likewise, the survivor will get the allowance maximum up to $1,663.81 monthly and the annual income must be below $29,976. And the allowance is huge, almost twice of OAS.

Pay-out details with Income and Age of all three categories of benefits:

How could the seniors apply for the OAS benefits?

If the seniors are already getting OAS and qualified for the grounds, then the data is automatically stored in the Service Canada’s database. There is no need for extra application. The agency will automatically count you for the GIS and will notify you. But in case of Allowance or The Allowances for Survivors, you need to fill out the application by visiting the Service Canada website. At first you have to open your My Service Canada Account.

You need to apply before 6 to 11 months of turning 60. Collect all of the information before applying like your SIN, you and your partner’s personal details, banking information etc. Then apply online by filling the GIS or Allowance form. Attach all the necessary documents and wait for the response. If you are applying offline then print the available form and fill it and attach copies of your documents and mail them or drop them at the Service Canada office. After the verification you will get informed. Then you will get your payment by direct deposit in your given bank account.

These financial boosters are relievers for a senior citizen. They can manage their day-to-day expenses out of it. Their residency along with the income threshold matters a lot in deciding the whole game of benefits. Your seniority will assure you to live or survive if you are getting yourself updated with these benefits. So apply and get the pay-outs on the right time.

| cmcollegebounsi |